Despite plummeting wholesale electricity prices in some areas of the US as well as essentially flat electricity demand in recent years, natural gas and renewable capacity is still being built.

In 2016, the Energy Information Agency (EIA) notes, natural gas-fired electric generation in the US increased by 3.4 percent; non-hydroelectric renewables like wind, solar, biomass, and geothermal increased by 15.7 percent; and conventional hydroelectric power grew by 7.5 percent. Coal electric generation, on the other hand, fell by 8.4 percent in 2016.

Those numbers only reflect the share of electricity generated by a certain type of fuel, not necessarily how many new power plants came online in 2016. But the natural gas expansion looks like it’s still gaining ground in certain areas of the country. According to TheWall Street Journal, at least two power plant companies—Invenergy and Calpine—are going all-out on building natural gas capacity in Pennsylvania and Ohio. Between those two states, Invenergy and Calpine are set to increase natural gas capacity by 8.6 gigawatts between 2018 and 2020.

What makes that number remarkable is that wholesale electricity prices have been extraordinarily low this year. But Pennsylvania and Ohio have an advantage: they sit on top of the Marcellus shale formation, a massive supply of natural gas.

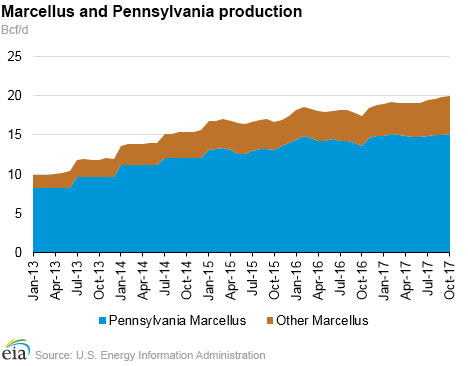

While power plant builders might see their revenues eaten away by lower wholesale electricity prices, they’re making up the difference through cheap fuel, especially when they can site plants close to Marcellus shale and save on transportation costs. According to EIA data, Marcellus shale production reached a record high in October 2017; Pennsylvania specifically supplies 19 percent of US natural gas. The WSJ notes that the price of natural gas “has plunged from highs of over $13 per million British thermal units in 2008 to less than $3 per million BTUs today.”

It has also helped that construction costs of building natural gas plants fell 28 percent between 2013 and 2015.

Despite all the additional gas being produced from the Marcellus formation, plans for new pipelines to move northeast natural gas to other markets were tied up in a regulatory morass for much of 2017. The Federal Energy Regulatory Commission (FERC) lost two of its members, and thus a quorum, shortly after the Trump administration took office. Replacements were not confirmed by the US Senate until August, which held up any possibility of approving new natural gas pipelines.

The glut of gas in the northeast has brought electricity prices in that heavily populated area down. The WSJ says that last year PJM, the wholesale grid operator in Pennsylvania, Ohio, and surrounding areas, saw some of the lowest electricity prices since they were tracked in 1999—$29.23 per megawatt hour.

A lot of the new generation being built in the northeast is replacing coal, much to the chagrin of elected officials who have promised to rescue coal mining and generation. But those low electricity prices make it extraordinarily difficult for coal to compete, barring government assistance. As a result, “Nearly 9.3 gigawatts of coal-fired electric generation have been retired in the past three years on the PJM grid, while 8.7 gigawatts of gas-fired capacity have been added in that same time frame,” the WSJ writes.

[contf] [contfnew]

Ars Technica

[contfnewc] [contfnewc]

The post Gigawatts of planned natural gas plants despite low electricity prices appeared first on News Wire Now.