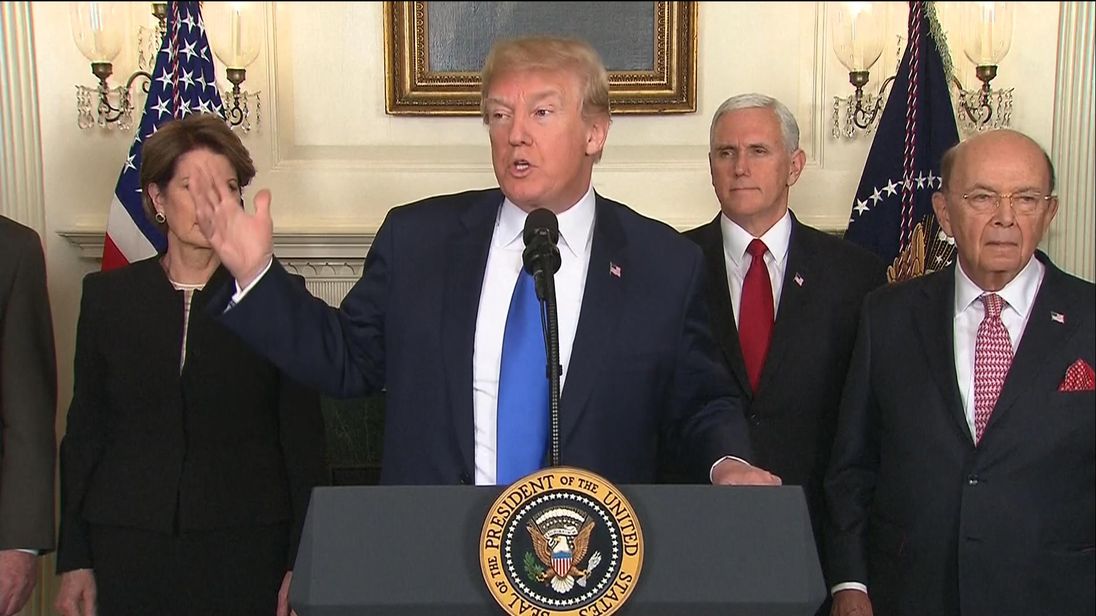

The International Monetary Fund (IMF) has launched an unusual attack on the economic policies of the US, warning that Donald Trump's plans will only end up swelling the mammoth current account deficit he has frequently complained about.

In its closely-watched World Economic Outlook (WEO) – its definitive set of projections for the world economy – the Fund said that the world economy was rebounding strongly, with stronger growth expected in the euro area, China, Japan and the US.

However, it said the prospect of a trade war was clouding those prospects.

The IMF is usually very careful to avoid direct criticisms of its largest shareholder, the US, couching its warnings in generic terms.

However, the Fund's chief economist, Maurice Obstfeld, said that the US should be deeply wary of starting a trade conflict with China, on which it has threatened to impose tariffs.

"These initiatives will do little… to change the multilateral or overall US external current account deficit, which owes primarily to a level of aggregate US spending that continues to exceed total income.

"Recent US fiscal measures will actually widen the US current account deficit," he warned.

He said the IMF actually expected Mr Trump's policies to widen the US current account deficit – a measure of how much the country is reliant on overseas imports and capital – by around $150bn in 2019 alone.

The comments represent the latest intervention from a community of multilateral institutions which have become deeply worried about the prospects of a trade war in the coming years.

:: Trade wars and the lessons from history

Mr Obstfeld said the fact that "major economies are flirting with trade war at a time of widespread economic expansion may seem paradoxical – especially when the expansion is so reliant on investment and trade."

The Fund upgraded its forecast for UK growth by 0.1% this year to 1.6%.

This means that the UK is no longer expected to be the weakest of the seven major industrialised economies this year or next, with both Japan and Italy growing at a slower rate.

However, the growth rate is significantly below the 2.5% trend growth rates that were typical before the crisis and is well below the 2.9% rate expected for the US and the euro area's 2.4%.

The IMF put the weak growth rate down to the UK's departure from the EU.

"Business investment is expected to remain weak in light of heightened uncertainty about post-Brexit arrangements," it said.

"The forecasts are broadly unchanged relative to the October WEO.

"The medium-term growth forecast is also broadly unchanged at 1.6%, reflecting the anticipated higher barriers to trade and lower foreign direct investment following Brexit."

A Treasury spokesman responded: "Our economy is at a turning point with our national debt starting to fall and the lowest unemployment rate for 40 years.

"We are building an economy that works for everyone by taking a balanced approach to supporting our public services, investing to improve our productivity and helping families keep more of what they earn."

More from Business

The Fund pointed out that the UK was hardly alone in facing a deterioration in its long-term growth rate.

It said: "Once their output gaps close, most advanced economies are poised to return to potential growth rates well below pre-crisis averages, held back by ageing populations and lacklustre productivity."

[contf] [contfnew]

Sky News

[contfnewc] [contfnewc]