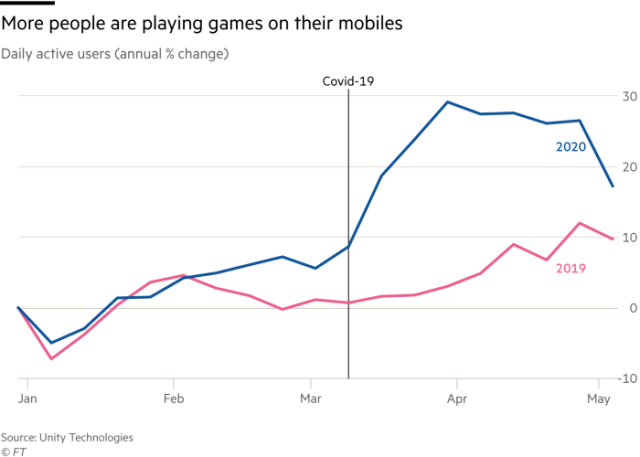

The coronavirus crisis has proved a bonanza for video game makers, as shut-in consumers turn to digital distractions in greater numbers and for longer sessions than ever before.

But while the sectors big listed groups such as Nintendo, Activision Blizzard, and Take Two have enjoyed share price rises of more than 25 percent since early March, a clutch of mobile gaming studios, many privately held, have enjoyed the real windfall. Along with the sudden rise in leisure time among a ready market of more than two billion smartphone owners, they have reaped the rewards of a plunge in mobile advertising prices as other corporate sectors slashed their marketing budgets.

“That gave a huge opening for companies like ours,” said Alexis Bonte, group chief operating officer at Stillfront, a free-to-play gaming group based in Stockholm whose share price has more than doubled since mid-March. “We got a double effect—the increased organics [usage growth] but also the effect of more efficient marketing . . . It was huge.”

Mobile gaming revenues, which already dwarf spending on PC and console titles, are now set to top $100 billion this year, according to data groups App Annie and IDC, more than triple the combined sum for Nintendo Switch, Xbox One, and PlayStation 4 titles. Companies such as Fortnite creator Epic Games, puzzle app specialist Playrix, and mobile games maker Playtika were each spending upwards of $2 million a day on digital ads in late March, April, and into May, games industry insiders say.

“Every other developer is looking at this as something that is unprecedented,” said Stephane Kurgan, former chief operating officer at King, makers of Candy Crush Saga.

Kurgan, who recently joined tech investor Index Ventures, says sheer scale gives mobile games companies greater upside from the pandemic than console publishers, outside the very biggest hits such as Nintendos Animal Crossing: New Horizons, Activision Blizzards Call of Duty: Modern Warfare, and Take Twos Grand Theft Auto V.

“A large majority of PC and console titles havent really benefited,” he said. “Its more the mobile free-to-play industry which has seen very material revenue spikes.”

US spending on console games—including physical discs and downloads from the Xbox, PlayStation, and Nintendo digital stores—jumped to $662 million in April, up 55 percent year on year according to market researchers NPD, with sales in May up 67 percent to $438 million.

Global top five games in iOS App Store, Q1

- Game for Peace (Developed by Tencent in China)

- Honor of Kings (Tencent, China)

- AFK Arena (Lilith, China)

- Candy Crush Saga (Activision Blizzard, US)

- Sangokushi Strategy (Alibaba, China)

Source: App Annie via Financial Times

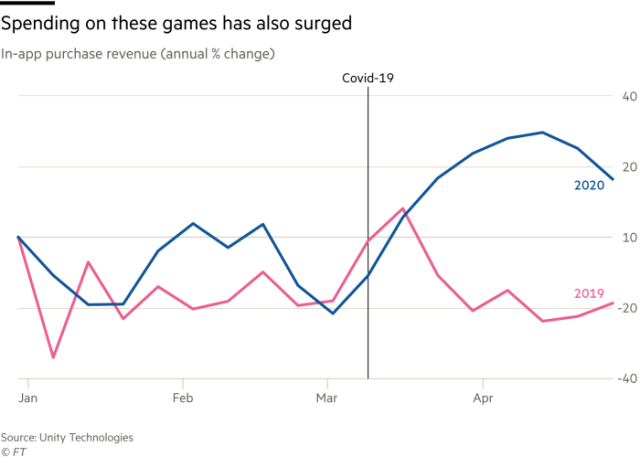

But in Europe alone, spending on mobile games grew 12 percent between February and March to $740 million, according to Sensor Tower, setting a new monthly record for the region at a time of year typically characterized by a post-Christmas decline.

Globally, daily “in-app” payments for mobile games—for the likes of extra lives, virtual items, and outfits for avatars—have jumped 24 percent since the pandemic began, according to gaming technology provider Unity. Smartphone users, meanwhile, have installed 84 percent more apps than the same period a year ago.

At the same time, Unity found that the average cost per install—the price games publishers must pay for ads that persuade new players to download their app—fell by an “unprecedented” 33 percent from March to April.

This set up a land-grab that powered up the lockdown gaming boom just as much as bored iPhone fiddlers. As many other marketers pulled their dollars out of the online auctions that determine most ad pricing, games companies swooped in to take advantage of the tumbling costs of reaching millions of eyeballs on Facebook, Google, and other networks.

In recent years, publishers of free mobile games have become among the most adept online marketers, fine-tuning a system that relies on constant testing and measurement. The goal is to ensure that the cost per install on each new players phone is exceeded by that gamers predicted lifetime value, usually generated through in-app purchases of extra lives, virtual items, and outfits for avatars.

Tracking CPI and LTV has become as much an obsession for games publishers as Roblox is for tweens.

“The whole mobile games industry has centred on those two key figures,” said Thor Fridriksson, chief executive of Teatime Games, a Reykjavík-based start-up that launched a new quiz app, Trivia Royale, in mid-June. “Its basically an arbitrage money machine. Thats the whole business right now.”

Boosting marketing budgets at a time of huge global uncertainty was nonetheless a multimillion-dollar gamble.

“It was a very stressful period,” said an executive at one leading mobile games developer who was splurging more than $2 million a day on ads at the peak of the pandemic. “You were spending a lot of money and you didnt know whether the world would end.”

The bet appears to have paid off for top-grossing games such as PUBG Mobile, Roblox, Candy Crush Saga, Gardenscapes, Fortnite, and, in China, Tencents Honor of Kings—which all featured among Sensor Towers top games by worldwide revenues for March and April.

“If you look at the league tables, what is striking today is that many of the games in the top 10 were there five years ago,” said Kurgan. “Nobody expected that.”

For years, investors viewed games as a hit-driven business, where todays Angry Birds would be topRead More – Source

[contf] [contfnew]

arstechnica

[contfnewc] [contfnewc]