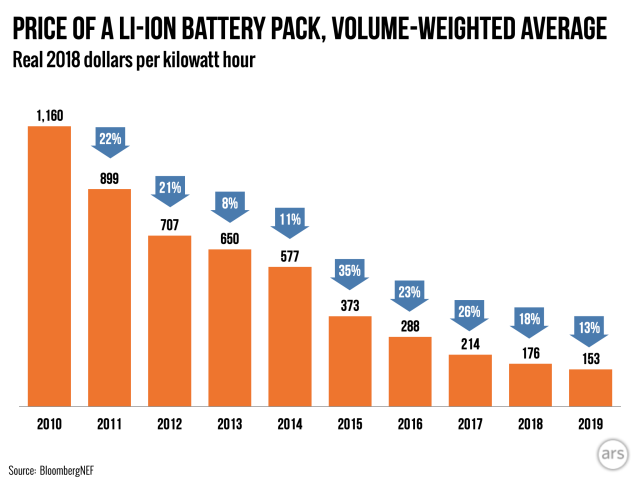

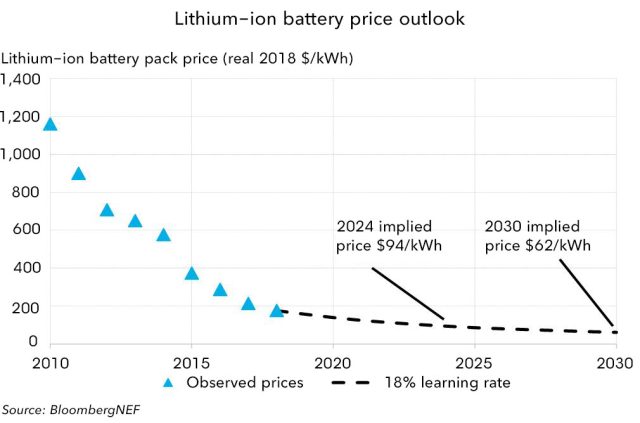

In 2010, a lithium-ion battery pack with 1 kWh of capacity—enough to power an electric car for three or four miles—cost more than $1,000. By 2019, the figure had fallen to $156, according to data compiled by BloombergNEF. That's a massive drop, and experts expect continued—though perhaps not as rapid—progress in the coming decade. Several forecasters project the average cost of a kilowatt-hour of lithium-ion battery capacity to fall below $100 by the mid-2020s.

That's the result of a virtuous circle where better, cheaper batteries expand the market, which in turn drives investments that produce further improvements in cost and performance. The trend is hugely significant because cheap batteries will be essential to shifting the world economy away from carbon-intensive energy sources like coal and gasoline.

Batteries and electric motors have emerged as the most promising technology for replacing cars powered by internal combustion engines. The high cost of batteries has historically made electric cars much more expensive than conventional cars. But once battery packs get cheap enough—again, experts estimate around $100 per kWh for non-luxury vehicles—electric cars should actually become cheaper than equivalent gas-powered cars. The cost advantage will be even bigger once you factor in the low cost of charging an electric car, so we can expect falling battery costs to accelerate the adoption of electric vehicles.

Batteries are a key technology for de-carbonizing electric power, too. We've seen robust growth of solar and wind energy sources over the last decade. But these carbon-free energy sources have a big downside: they only generate power some of the time. Customers, of course, expect power all the time.

Batteries provide an obvious solution. But here again, high costs have been an obstacle. Current prices still make it cost-prohibitive to use batteries to distribute daytime solar energy evenly over 24 hours. Rather, most utility-scale battery installations today are used to smooth out shorter-term fluctuations in supply and demand. A lack of storage limits how much solar and wind energy can be usefully integrated into the electric grid.

So continued declines in battery prices over the next decade will be a huge help as the world tries to de-carbonize, too.

Batteries have already gotten six times cheaper within the last decade, and that trend looks to continue to a lesser extent moving forward—but how did we get here? A number of factors from increased demand to smart grid solutions have been a factor. And perhaps most notably, Tesla has played an important role throughout this process. Tesla obviously helped to popularize the concept of a long-range battery electric car, but Tesla has been a battery company as much as it is a car company. Tesla recognized the potential scale of the battery market before most other companies and has become a leading player in the market for grid storage—a market that's poised to become much bigger over the coming decade.

Cheap, powerful batteries made electric cars possible

Getting data on the true cost of batteries is difficult because so much of the market involves big companies negotiating private deals—often with substantial volume discounts. BloombergNEF is a research and consulting organization that has relationships with a wide variety of players in the battery business.

"We leverage our contacts across all sectors of the value chain," said James Frith, the lead author of BloombergNEF's battery surveys. "We talk to both end users as well as manufacturers and other people working in the industry. We talk to most of the large auto makers who are active in the electric vehicle space and the majority of the tier 1 battery manufacturers in China, Europe, the US, and South Korea."

Their data shows battery costs falling more than sixfold since 2010. Cheaper batteries have expanded the market, which has helped to drive costs even lower.

This process was going on even before 2010. Think back to 2003, the year Tesla was founded. At the time, a booming market for laptops and cell phones was rapidly expanding the market for lithium-ion batteries. Companies were pouring millions of dollars into research and development to make batteries cheaper and more powerful.

JD Straubel, an electrical engineer who went on to become the CTO of Tesla, realized that these batteries had gotten good enough—and would soon be cheap enough—that you could use a few thousand of them to power an electric car. He brought the idea to Elon Musk, who provided early funding to Tesla based on the concept. A decade later, Tesla and Panasonic built a massive battery factory in Nevada called the Gigafactory that was designed to produce 50 GWh worth of battery packs annually. The investment made Tesla one of the world's biggest producers—and users—of lithium-ion batteries.

In Tesla's early days, batteries were still so expensive that it was only viable to sell the Roadster, a battery electric sports car with a six-figure price tag. But as batteries continued improving in cost and performance, Tesla was able to build the lower-cost Model S and then the much cheaper Model 3, which consumers can now buy for less than $40,000.

Enter the Roadster

"Model S was designed and introduced about five years after the Roadster, and we saw improvements of around 40 percent on the battery technology, the fundamental chemistry, the packaging of the battery pack itself," Straubel said in 2014. "That directly translated into how we can get close to 300 miles of range in a Model S, almost 85 kWh of energy storage in a pack that's actually smaller than the Roadster pack."

Today, of course, people still buy many more cell phones and laptops than electric cars. But a battery electric car needs so much battery capacity—40 to 100 kWh, thousands of times more than a smartphone—that they've significantly increased the global demand for lithium-ion batteries. That has helped drive additional price declines, which have started to make it cost-effective to use batteries to improve the electric grid.

How batteries are improving the electric grid

In 2017 Tesla completed installation of a massive battery system at the Hornsdale Wind Farm in South Australia. The wind farm's storage capacity was 129 MWh—about as much as 2,000 Model 3s or 10 million smartphones. The system's owner, the French renewable company Neoen, considers it such a success that it plans to expand its capacity by 50 percent.

The battery is designed to deliver energy at a rate of 100 MW. With 129 MWh of storage capacity, that means that it can run out in a little more than an hour. But an hour of spare capacity can be hugely valuable. To ensure uninterrupted service, electric utilities rely on "peaker plants"—often gas-fired generators—that can be powered up at a moment's notice during times of stress. Because these plants may only run for a few hours a year, the per-hour cost can be very high. Australian utilities have sometimes been forced to buy power on the spot market from suppliers who are able to charge as much as 50 times the usual rate.

The Hornsdale battery has allowed the region's electric utility to largely opt out of this spot market. Neoen claims that the battery has already saved customers in the region tens of millions of dollars, while simultaneously making the region's grid less susceptible to blackouts.

Saving utilities money during peak loads is nice for the utilities, but the environmental benefits may not be very significant. The big environmental benefits will come in the next phase, when the electric grid has enough batteries to store a significant fraction of the day's energy demand. That will allow the grid to store up several hours worth of solar energy during the daytime and discharge it at night—allowing renewable energy to supply most or eventually all of the electricity. With enough capacity, we could even store energy across seasons, holding an excess of solar power from the summer to keep electrons flowing during the winter.

Short term and long term

The sorts of small, fast-response batteries that help balance out short-term fluctuations may not be the best option for these longer-term storage needs. There are a number of other battery technologies in development—most notably flow batteries—that may be better-suited to this sort of storage. And whatever battery technology that is used will have to compete with alternate energy storage methods. Some of those, like pumped hydro, compressed air, and heat storage, are already in use in limited cases. Others, like using electricity for the production of fuels, are still in development.

The Hornsdale battery might have been the biggest in the world at the time, but its capacity is still tiny compared to US electricity demand. The US consumes roughly 10 terawatt-hours each day—more than 70,000 times the capacity of the Hornsdale plant. With battery costs continuing to fall and renewable power sources proliferating, demand for utility-scale battery installations will only increase in the coming years. In its quarterly earnings report last month, Tesla said it had multiple orders to build battery systems even bigger than the Hornsdale battery at sites around the world.

How rising demand drives falling prices

The more units of something that get manufactured, the lower the cost per unit tends to be. Economists define the learning rate as the percentage decrease in cost for every doubling of manufacturing output. Last year, BloombergNEF estimated the learning rate for batteries at 18 percent. That is, battery costs have tended to fall by 18 percent every time global battery output has doubled.

This is a key factor in the group's estimate for future price declines. They assume that the market will continue to expand as people buy more electric cars and electric utilities buy more grid storage systems. And BloombergNEF believes that the market will have grown enough by 2023 to push the cost per kWh down to $100.

Several factors contribute to these cost reductions. One is sheer economies of scale. There are upfront costs involved in developing a new battery technology. Further capital expenditures are needed to build a factory to manufacture it. The more units a factory produces, the more these costs can be spread out, allowing each unit to be a bit cheaper.

"We've seen the size of factories themselves increase, going from 1 or 2 GWh in 2010 to now 30 GWh," Frith told Ars.

Larger scale also gives battery manufacturers more purchasing power. Suppliers almost always offer customers discounts if they commit to large orders—partly because the suppliers have economies of scale, too.

In a 2014 talk, Straubel explained how the scale of Tesla's gigafactory—which was about to begin construction—would help drive down battery costs:

We're going far upstream in the cell manufacturing process. We're not just looking at how do we do a winding of a cathode or anode better, but we're looking at coating, we're looking at the material synthesis to build the cathode and anode, we're actually going all the way back to literally some of the places where the raw materials come from. If you start breaking down the cost and build a big pie chart of what's driving cost of a lithium-ion battery today, the materials are actually a reasonable part of that. But even those material prices can be reduced if you drive the right volume and drive purchasing power into how you're buying them.

Technological improvements also play a role in driving down battery costs. Frith points out that the term lithium-ion battery is actually an umbrella term for a number of different battery chemistries. Over time, scientists have created new mixtures that deliver more and more energy per kilogram. This not only lowers the cost of the chemically active parts of the battery, it also means that batteries can be physically smaller and lighter for a given power budget, which reduces the per-kWh cost of every other component.

Frith told Ars that a common battery technology in the last decade was "NMC 111" batteries with equal parts nickel, magnesium, and cobalt. Now companies are starting to move to NMC ratios of 811—with eight times as much nickel as manganese orRead More – Source

[contf] [contfnew]

arstechnica

[contfnewc] [contfnewc]