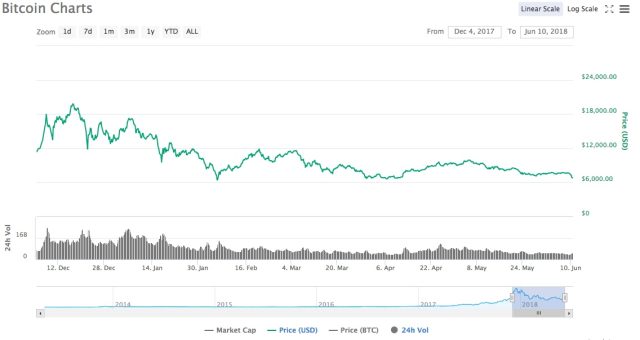

On Sunday, the price of Bitcoin continued to fall, losing 5 to 6 percent of its value.

According to CoinMarketCap, since an all-time high of near $20,000 per bitcoin on December 17, 2017, the cryptocurrency has lost more than half of its value, currently trading at around $7,200.

Overall, Bitcoins price is up by about 150 percent compared with this same time last year, when it was trading around $2,800.

Such fluctuations don't seem to have stopped demand for setting up new mining operations, particularly in areas where electrical power is relatively inexpensive. Demand is so high in one part of Canada, that Hydro-Québec, the provinces energy utility, recently said that it would "temporarily" stop accepting energy requests from cryptocurrency mining companies "so that the company can continue to fulfill its obligations to supply electricity to all of Québec."

The move comes as three months ago, utilities in neighboring New York state announced they would be raising rates for mining companies.

"The blockchain industry is a promising avenue for Hydro-Québec," Éric Filion, President of Hydro-Québec Distribution, said in a statement.

"Guidelines are nevertheless required to ensure that the development of this industry maximizes spinoffs for Québec without resulting in rate increases for our customers. We are actively participating in the Régie de lénergies process so that these guidelines can be produced as quickly as possible."

Also last week, two of Bitcoins most public critics, Berkshire Hathaway CEO Warren Buffett, and JP Morgan CEO Jamie Dimon, again expressed their deep-seated skepticism in the worlds most popular energy-hungry digital form of money.

[contf] [contfnew]

Ars Technica

[contfnewc] [contfnewc]